Income inequality is one of the biggest barriers to sustained growth today. You can’t have a consumer economy without income reasonably well distributed, and such an economy is going to have more sustained, reliable growth. But as we’ve shown before, income inequality has grown since 1968, threatening long term growth.

Here is another way to look at that rising inequality as part of a long-term trend that defined 1968-2000 – the expansion of the workforce and subsequent collapse of that expansion that will solidify when the Baby Boom hits retirement. Economic changes are often demographic at heart, and we are due for some major upheaval that we need to be ready for.

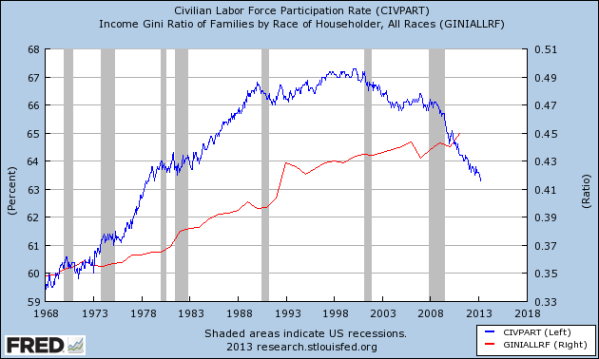

Let’s start with a graph from our old friends at the St Louis Federal Reserve. This is a chart where the blue line shows the percent of the population over 16 years old that has a job of some kind – part or full time. The red line is the GINI index as discussed earlier, rising to show the income inequality over that same period of time.

The percent of the working age population with a job in 1968 was about 60%, which then climbed rather steadily to about 64% through the difficult 1970s before taking a pause. From there, it inched up to 67% in the late 1980s, peaking at 67.3% in 1999. From there, it’s been only down – finding a plateau of 66% again before taking a dive in 2008. It’s now at 63.5%.

On the right scale the left line shows that inequality continued to rise with a brief pause in the 1990s. They seem unrelated. But are they?

The tremendous increase in the percent of the population working seen from 1968-1990 is the result of women entering the workforce. This is not talked about much because it’s hard to point to this achievement without calling some undue attention to the changes that took place as a result. But at this point we have to take it as a historical fact – something that was inevitable and is now irreversible. The available pool of labor is much larger than it was in 1968.

During this time, the percent of adults officially “retired” varied little, from 19-22%. There was a cap of no more than about 79% of adults employed as a possible maximum. At the 1999 peak, no more than 12% of the population was either a full-time student, stay at home parent, or not physically or mentally capable of working. That’s full employment by any measure.

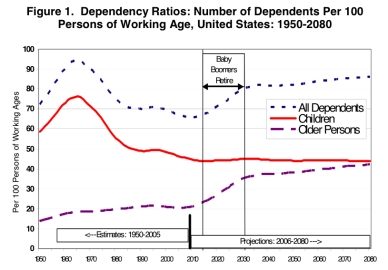

Starting in 2011, the very oldest Baby Boomers became eligible for retirement. That will accelerate through the next 20 years, eventually raising the retired percent of the population to as high as 36% by 2035. Today’s apparent “crash” in workforce participation will soon be the maximum at about 64% –likely to be more on the order of 52%, using the same 12% not participating.

Why is this important? Let’s get back to income inequality, which occurs when labor is less valuable than investment. As women entered the workforce there was a larger pool of labor to draw from, putting downward pressure on wages. It’s simply a matter of supply and demand – more people looking for work means you can pay less, as everyone knows they can be replaced by someone hungry on the outside. That ended in the 1990s, the time when it was almost possible to imagine income inequality leveling off and maybe one day retreating. But then this Depression hit.

We can be sure that the workforce is going to start contracting, meaning that while there are fewer jobs to go around the relative number of people who can fill them must contract. At some point, we can see a logical equilibrium – and upward pressure on wages. That might be what it takes to reverse the inequality out by around 2020 or later, after this Depression eases around 2017 or so.

There’s a catch, however. Whereas half of each household was often voluntarily out of the workforce in 1968, the next economy will have retirees to support. Will each family take care of their own? Or will it mean that higher wages will be met with higher taxes for Social Security?

That’s the situation that we can reasonably expect as the demographic trends continue to work their way through. What we do know is that workforce participation will continue to pull back from an all-time high as retirees become a larger share of the population. In the past, Barataria has called for an acceleration of this trend as a way of ending the Depression.

In any case, we can expect upward pressure on wages in the future and, as a result, an improvement in income inequality. The decision today is how we set ourselves up to manage this developing trend.

Brilliant, as always, but I expect you will catch hell for blaming income inequality on women entering the workforce. Everyone is too PC to talk about this but it was a huge trend that cannot be denied and I salute you for taking it on. I will think about your conclusions a bit more. I see Mr. Sunshine still has a lot of hope for the future. 🙂

I do expect to catch Hell for this, but I can’t see this any other way. Workplace equity was inevitable so I don’t see any point in arguing it, but a dramatic increase in the population working has to put downward pressure on real wages over that same time – and I think that’s what we see.

As for the future, I don’t know that it is bright unless we learn how to manage a large pool of retirees. Progressive taxes to support Social Security are starting to look absolutely essential by about 2020. If we can manage through that, we’ll be OK. The way things sit right now we can’t even think about something that intelligent coming out of Congress.

Can we expect similar trends if immigration reform happens? From my underemployed point of view (at age 30, sigh..), it all seems like a scheme to depress wages further.

An excellent question on immigration reform. I doubt it brings anywhere near as many people into the workforce as this – we’re talking here about a rise of 7% of the population or about 21M people. That clearly had a big role in depressing wages in the 1890s, for example, but I don’t see it happening that big today. I will look into it, though.

I can’t help but notice that this graph of percent with a job also shows the start of the change in 2000. Is there anything that doesn’t point to the start of the depression in 2000?

It’s very consistent, isn’t it? That was the start of the secular bear market and a very clear inflection point by any standard. Things started to change at that point. What makes this a “Managed Depression” is that the Fed and the US Government started running a lot of different stimuli to keep things moving, but only inflated a bubble in the process. I think history is very much going to see 2000 as the turning point in nearly every respect, yes.

Note also that the previous cycles were 1965-1983 (the “Summer” or stagflation doldrums stage) and 1983-2000 (the “Autumn” or high growth bull market. This “Winter” did start around 2000, but should end around 2017 and maybe as late as 2020. The inequality has been a feature of the last 3 “seasons” and should reverse with the next “Spring”. Fascinating stuff, isn’t it?

This is what I want to write the book about. 🙂

Salon had an interview yesterday with the author of “you are not a gadget”. In his new book he still talks about how technology has replaced so many jobs (atms replacing tellers etc.) and how new large classes of middle class jobs have not emerged to replace those lost. he talks about how we had a formalized economy that was structured with pensions, social safety nets and other levees against the informal economys of slums and ghetto. He says that many in the right wing are tearing down those levees with a winner take all society.

I had a slightly interesting experience Friday. A sign post installer was putting up a real estate sign in the neighborhood. I stopped to talk to him as I did the exact same thing in the summer of 2008. I asked him if he liked his job and he said he hated it ( it was a beautiful day but he is 45 and the job is causing back, shoulder and neck pain) he has been doing it for 6 years. He was formerly a wood flooring installer and he had pride in a job well done. His brother is 55 living at home with his Mom and has been unemployed for 4-5 years. I got that information by asking how does his brother make it being unemployed so long.

Now this is one of my greatest fears when I am doing my miniature field studies. I have a hunch a lot of middle class wealth and income is being used to help out their lesser brethren and that is a good thing. Unable to find good reliable literature on this mostly just informal reports of parents helping out their young adult children. But what happens when the economy shifts further away from a bell curve and the money is skewed to the very few.

Yesterday’s “productivity gains” are today’s “unemployment”, for sure. And it is sad that we have a government that is not in any way looking out for the poor – even the simplest things have become hard.

I agree that the role of females entering the workforce has likely been understated for political/ideological reasons. After WWII, women were openly pushed out of the workforce, which is clearly not doable now. Thanks for focusing on this.

On the other hand, the role of “free trade” in advantaging capital over labor needs more attention. Left media are sounding the alarm about the “Transpacific Partnership” etc, but I see little or nothing about it in the mainstream media. US labor interests clearly no longer have the clout to be real players in setting national policies.

It appears to me that most US voters no longer have much ability to identify and vote their own interests. So yes, there are trends suggesting upward pressure on wages. But others continuing to push downwards. I think substantial reduction of inequality would require aggressively more progressive tax policies. How to get there is not obvious. To put it in another, perhaps bombastic way, the wealthy finance types who have stolen so many pension plans need to make up shortfalls in social security accounts out of *their* pockets, not ours. Else, we are going to see massive numbers of old folks in destitution.

I really expected more Hell than I’m getting. 🙂 Studies have been done on how free trade supresses wages, and I will try to see if there is something that is really useful for this. My gut has always told me that the strong dollar has a huge effect on this, given that we’ve been running 10-20% over purchasing power parity for 30 years. So there are a TON of other effects going on here, of course.

But I think the narrative that we spent 30 years absorbing a historic shift in the workforce, only to have a cyclical downturn hit just as we were fully normalizing that shift, is a compelling story IMHO.

Granted, a lot of policy changes (as I outlined before) can mitigate many of these effect, and I’m starting to think that paying attention to the relative value of labor vs capital is crutial.

And yes, the needs of Social Security in the future will HAVE to come from a uniform tax on all income, not just earned (and especially not just the first $110k). This is a big deal, but it will become obvious sometime after 2020 for sure. I think we need to move that direction now.

How about this for another field study. I am a bus driver and I know a woman who works at Walmart. The way she survives is by renting a basement apartment from friends. I think this is one area where nickeled and dimed by barbara ehrenreich fell short. The informal networks.

Everyone is surviving with connections and some kind of break from friends. We have really closed down as a society. Networking is great for the individual but overall it makes class rising and so on much harder.

Very interesting. I agree with the other commenters that there are a lot of other effects but I can see how a big social change with so many entering the workforce would supress wages. Maybe this is one of those things we walked into blind when we should have been paying more attention?

Yes, we should have been paying more attention.

I’m wondering what we should have been paying attention to, though. You know I love to find simple measures that seem to correlate with bigger picture trends, but I can’t find anything that expresses the balance between return from investment versus return on equity in a way that makes sense.

Pingback: ‘Liberalism’s Most Challenging Task’ Is Clearer Writing | sambhalkezabaan

So let’s compare someone who has a minimum wage job and someone else has the CEO’s job, a high paying job….is that too much inequality and what should obtain?….are they paid according to productivity level and risk and responsibility or not?

How do you plan to resolve that?…force an increase in the minimum wage to say $20, $30, $40 or $50/hr. Or enforce salary maximums? That’s the only way to solve income inequality and would have disastrous consequences, including more unemployment.

It is not the only way to solve inequality, far from it. The balance of power between boards and shareholders is a critical issue here. There does not seem to be much power among shareholders, and they are largely incapable of organizing. I would start there when considering executive pay.

Pingback: A Coming Golden Age. Really. | Barataria - The work of Erik Hare

Pingback: Poverty Persists | Barataria - The work of Erik Hare

Pingback: Triple Threat | Barataria - The work of Erik Hare

Pingback: Dissin’ the Jobs Report | Barataria - The work of Erik Hare

Pingback: Good, Evil, Puzzling, & Stupid | Barataria - The work of Erik Hare

Pingback: Jobs Debate Heats Up | Barataria - The work of Erik Hare

Pingback: The Immigration Solution | Barataria - The work of Erik Hare

Pingback: Point of No Return | Barataria - The work of Erik Hare

Pingback: Inequality: A Feature of the System | Barataria - The work of Erik Hare

Pingback: Enough Work? | Barataria - The work of Erik Hare

Pingback: Player Piano | Barataria - The work of Erik Hare

Pingback: Tax Profits, Not Labor! | Barataria - The work of Erik Hare